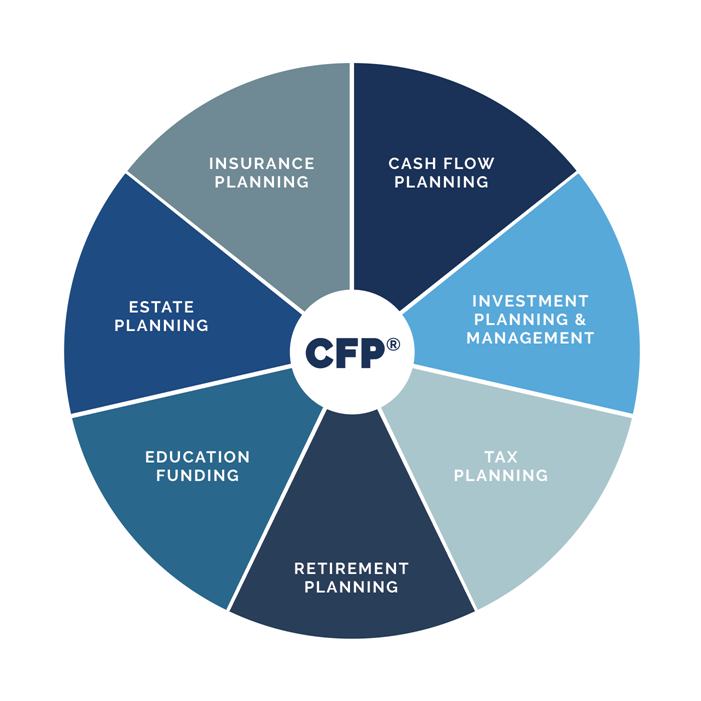

CERTIFIED

While many call themselves financial planners, a CERTIFIED FINANCIAL PLANNER™ is a professional who has completed extensive training, met work experience requirements and is held to rigorous ethical standards. The principals at Core Wealth Management are CERTIFIED FINANCIAL PLANNER (CFP®) professionals..

The CFP® professionals at Core Wealth Management are uniquely qualified to coordinate the many aspects of your financial situation. As skilled advisors, we understand the evolutionary nature of both the overall financial climate as well as the countless transitions that people face throughout their lifetimes.

Cash Flow Planning

Includes determining the timing and amount of your cash needs and devising a saving strategy to increase the likelihood that those needs can be met.

Investment Planning and Management

Includes defining your objectives, your risk tolerance, and your time horizon to develop an asset allocation plan. Specific investments are selected to implement the plan in a tax and cost-efficient manner across your accounts.

Retirement Planning

Encompasses quantifying the level of resources that will be necessary for you to retire, and then devising a plan to help you amass and then ultimately distribute those resources. This includes determining when to collect social security benefits and evaluating pension collection options.

Tax Planning

Taxes impact many elements of a financial plan, and while they should not solely drive any financial decision, they should be considered. Optimizing tax efficiency when it comes to portfolio management, savings tactics, and distribution strategies is of paramount importance.

Insurance Planning

Asset and income protection is a critical component to any financial plan. Ensuring you have adequate life, disability, long-term care, liability, and homeowner’s insurance will provide confidence that financial plans are not jeopardized if an unanticipated event occurs.

Estate Planning

An integral component of any financial plan, estate planning ensures that you have the appropriate documents in place, assets are titled as you wish, and beneficiaries are named so that assets will be transferred in an efficient and cost-effective manner that is consistent with your wishes.

Education Funding

In addition to quantifying a total funding need, we recommend cost-effective and tax-efficient alternatives, including 529 Savings Plans, 529 Prepaid Plans, Education IRAs, UTMA accounts and trust accounts.