Despite rising mortgage rates, real estate prices in Florida continue to climb, leaving many Florida homeowners feeling trapped in their current homes. As real estate prices increase, so do property taxes. However, homeowners can mitigate this through the Homestead Exemption. This article explains how the Homestead Exemption works, how property taxes are calculated, and the concept of portability.

The Homestead Exemption and Save Our Homes Amendment: A Closer Look

The Homestead Exemption is a property tax relief program that reduces the property tax burden on residential homeowners. In Florida, homeowners who make their property their permanent residence and file the state application may receive a property tax exemption of up to $50,000. This exemption comes in two parts:

- The initial $25,000 applies to the entire property tax.

- The subsequent $25,000 applies only to non-school taxes and covers the assessed value exceeding $50,000.

In addition to the $50,000 Homestead Exemption, there’s the Save Our Homes (SOH) Amendment. This limits annual assessment increases on a homestead-exempt property to 3% or the percent change in the Consumer Price Index (CPI), whichever is less. This slows the growth of the homeowner’s property tax bill over time.

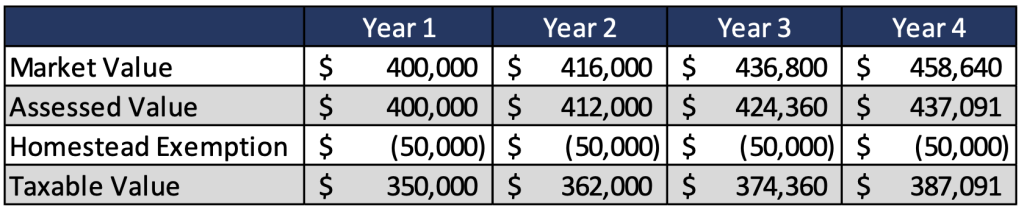

Below is an example of how the Homestead Exemption and SOH benefit are incorporated to determine the taxable value of a home. The example shows the market value of the home growing at 4% per year and the assessed value growing at the 3% cap:

The property tax rate is then applied to the taxable value.

Portability of Tax Benefits in Florida: Scenarios and Considerations

Whenever a homestead property is sold, the assessed value resets to its market value, affecting the taxable value for the new owner.

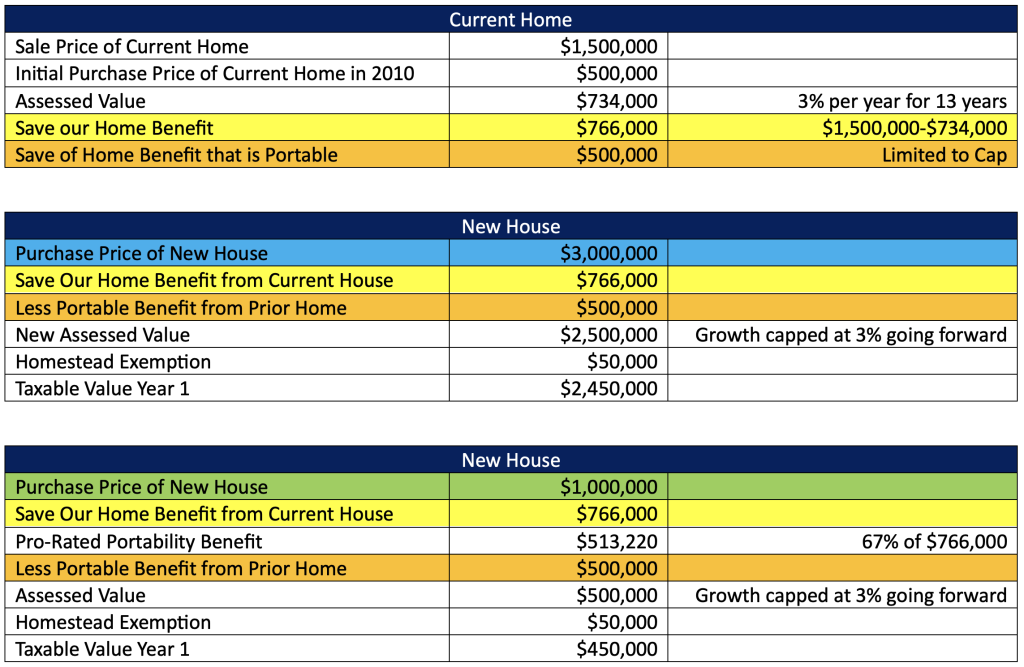

If a Florida homeowner sells an existing homestead property and purchases another property they wish to homestead, portability allows property owners to transfer a portion or the entirety of the Save Our Homes benefit from their former primary residence to their newly acquired primary residence. The transferable amount depends on the market value of the new primary residence.

- If the new residence has a higher market value, you can transfer your entire SOH benefit.

- If the market value of the new residence is lower, a percentage of your accumulated SOH benefit can be transferred.

- In both cases, your transferable SOH benefit is capped at $500,000.

Consider the following:

Whether you are considering a first-time home purchase or evaluating whether or a not a move is feasible for you, the fee-only financial advisors at Core Wealth Management are here to help. Most purchasers focus on the purchase price, but it is also critical to consider the ongoing costs associated with home ownership, including mortgage expenses, homeowner’s insurance, repairs and maintenance and of course, property taxes.