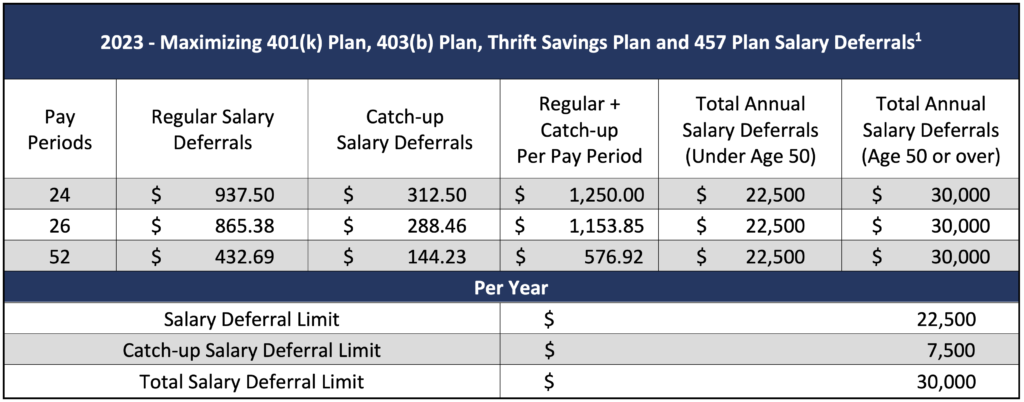

The Internal Revenue Service (IRS) has taken notice of the rise of inflation and has adapted by increasing the contribution limits to company retirement plans. Below is a chart showing how much an individual should contribute to their 401(k) plan through salary deferrals per paycheck to maximize their 2023 employee contributions.

A couple of things to note:

- Some payroll companies, such as Paychex, require a separate withholding for catchup contributions, so set that up accordingly.

- The limits for Roth 401K contributions are the same as pre-tax contributions.

- You can front-load contributions by contributing more per pay period. However, be aware that for certain plans that provide matching contributions each pay period, front-loading may result in the loss of some of the employer match.

- Any employer contributions are in addition to these amounts.

Between the ease of automatic contributions, the current and future tax savings, and the benefit of employer contributions, the company retirement plan is one of the best ways to save for retirement. If you are eligible to participate in a company’s retirement, take full advantage by increasing your contributions and taking advantage of these higher limits.

1 Other considerations and limitations may apply, especially for highly compensated employees. Individual plan documents should be reviewed to determine if other restrictions may be applicable.