The 2016 budget bill signed into law by President Obama on November 1st, 2015 included several changes to how social security benefits can be claimed.

First, let’s review some of the Social Security basics. Prior to the new budget bill going into effect, a Social Security participant could claim a reduced benefit as early as age 62, claim a full benefit at Full Retirement Age (age 66 for those currently entering retirement), or earn delayed retirement credits until age 70, when the benefit could be up to 32% higher than the age 66 benefit. This basic framework has not changed.

Additionally, married couples had the opportunity to further enhance their benefits by executing a series of claiming strategies that ultimately allowed one of the spouses to claim a spousal benefit while simultaneously earning delayed retirement credits. The new budget bill effectively ends this type of claiming strategy by changing the rules regarding restricted applications and file and suspend:

Restricted Application: With a Restricted Application, a participant applies for benefits but elects to take the lower spousal benefit, in order to earn delayed retirement credits for their own benefit. With the new legislation, the Restricted Application will no longer be an option. This means that a participant can no longer choose to collect a lower spousal benefit while their own benefit grows, and will automatically collect the highest benefit available.

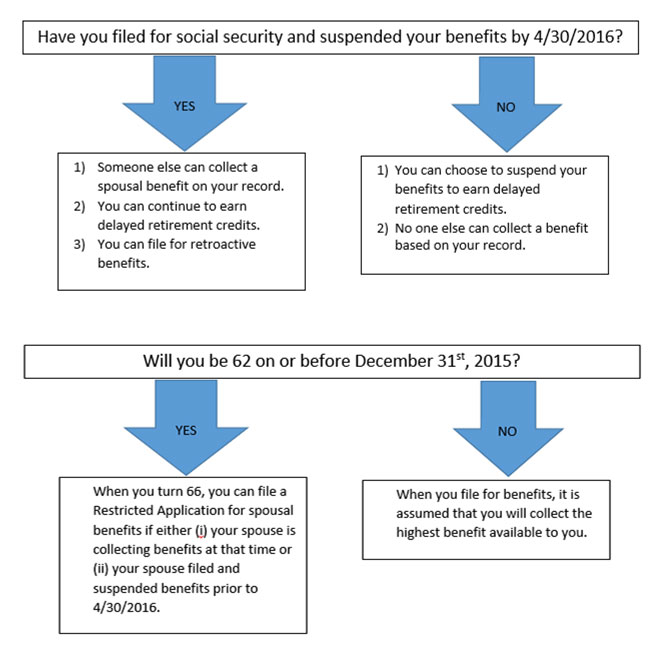

This rule is being phased in over time.

If you will be age 62 on or prior to December 31st, 2015, the Restricted Application option is still available to you. That means, at age 66, you can still choose to file a Restricted Application to only collect spousal benefits, thereby allowing your own benefit to grow. If you will turn age 62 after December 31st, 2015, the Restricted Application option is no longer available to you. When you file for benefits, you will automatically collect the higher of your own retirement benefit and your spousal benefit.

File and Suspend: File and suspend is the process of filing for benefits, and then suspending those benefits. This procedure allowed a person to earn delayed retirement credits while also allowing a spouse to collect a spousal benefit. Under the new legislation, a spouse will not be permitted to collect a spousal benefit on a primary benefit that has been suspended. Additionally, the new legislation eliminates the ability to request a retroactive lump sum for benefits. This rule is also being phased in over time.

If you are currently suspending your benefits OR if you elect to suspend your benefits prior to May 1, 2016, you fall under the old set of rules. In other words, you are grandfathered in. You can file for retroactive benefits and your spouse can collect a benefit based on your record even if you have suspended your benefits.

Beginning on May 1, 2016, you can still elect to suspend benefits, however, a spouse will not be able to collect on your record while your benefits are suspended.

Please keep in mind that these changes do not necessarily mean that delaying social security benefit until age 70 is no longer a good strategy. It just means that in some cases, delaying will not be as good a deal as it was before.

Please keep in mind that these changes do not necessarily mean that delaying social security benefit until age 70 is no longer a good strategy. It just means that in some cases, delaying will not be as good a deal as it was before.